Selling a House with Fire Damage in Maryland

Sell Your House Fast To A Trusted Local Home Buyer For The Highest Price Without A Realtor

Receive a Fair & FREE

No Pressure Cash Offer

Simply Call Us Or Fill in The Form Below For Your No Obligation “As-Is” Cash Offer!

Free Offer Form

We will get back to you as soon as possible.

Please try again later.

Maryland Fire-Damaged Home Sales: What to Know

Fire-damaged homes in Maryland often carry a stigma, but they can also present unique opportunities for sellers and buyers alike. Selling such a property involves understanding legal requirements, market conditions, and buyer behavior.

This process requires careful planning and attention to detail to ensure a successful transaction. Whether you're dealing with recent fire damage or an older incident, the path to a successful sale is paved with critical decisions and strategic planning.

Maryland's real estate situation requires a thoughtful approach to fire-damaged properties. From assessing the extent of the damage to pricing your home competitively, each step carries significant weight. "The essential processes involved range from immediate post-fire actions to closing the deal."

We'll explore repair options, marketing strategies, and alternative selling methods designed for your specific needs. You'll gain insights into state-specific disclosure laws, learn how to target the right buyers, and understand the role of specialized real estate professionals in maximizing your property's value.

After going through this guide, you'll have the knowledge needed to confidently navigate the Maryland real estate market. Whether you choose to restore your property or sell as-is, you'll have the information to understand legal requirements, set realistic expectations, and potentially turn a challenging situation into a profitable opportunity.

Visit The How it Works

Learn how our process works. We show you a real case study of a house we bought in cash.

Learn About Our Company

Find out who we are & make sure you’d feel comfortable selling us your home.

Request Your Cash Offer!

Fill in the form or call us. We will get with you ASAP to get your offer started!

Sell Fire Damaged House for Cash Quick

Sell Your House Fast, To A Legitimate House Buying Company You Can Count On. ✔️ Free, Easy & ✔️ No Pressure Process. Find Out How We Buy Houses!

We Buy Homes With Fire Damage In Maryland

Allegany County, Anne Arundel County, Baltimore County, Calvert County, Caroline County, Carroll County, Cecil County, Charles County, Dorchester County, Frederick County, Garrett County, Harford County, Howard County, Kent County, Montgomery County, Prince George's County, Queen Anne's County, St. Mary's County, Somerset County, Talbot County, Washington County, Wicomico County, Worcester County.

Assessing The Fire Damage

When selling a house with fire damage in Maryland, thoroughly assessing the extent of the damage is your crucial first step. This evaluation will guide your decisions and help set realistic expectations for potential buyers.

Immediate Steps After A House Fire

Once the fire department declares your property safe to enter, take these essential steps:

1. Document the damage:

- Capture extensive photos and videos of all affected areas

- Create a visual record for insurance claims and potential buyers

2. Secure the property:

- Board up broken windows and doors

- Prevent further damage from weather or unauthorized entry

3. Contact your insurance company:

- Notify your insurer promptly

- Initiate the claims process

- Discuss coverage for repairs or restoration

4. Salvage important documents:

- Retrieve undamaged papers like property deeds and insurance policies

- Secure these documents for the selling process

Professional Damage Assessment

Consult the experts for a thorough assessment. A qualified inspector or restoration contractor will:

- Assess structural integrity:

- Examine load-bearing walls, foundations, and roof structures

- Determine if there's any compromise to the building's stability

- Evaluate electrical and plumbing systems:

- Check for hidden damage to wiring and pipes

- Identify smoke and water damage:

- Assess visible and hidden effects of smoke

- Evaluate water damage from firefighting efforts

- Provide a detailed report:

- Outline the full extent of the damage

- Serve as a valuable resource for discussing repairs or pricing with potential buyers

Impact On Property Value

Understanding how fire damage affects your home's value helps set realistic expectations. Consider these factors:

- Extent of damage:

- Minor cosmetic damage may have limited effect

- Significant structural damage can substantially decrease value

- Age of the property:

- Older homes may see more significant value reduction

- Outdated building materials and potential code compliance issues play a role

- Quality of repairs:

- High-quality restoration work can positively influence the property's final value

- Market conditions:

- Overall real estate market in your Maryland location affects damage impact

- Time since the fire:

- Recently damaged properties may face more scrutiny

- Homes with older, well-documented repairs might see less impact on value

By carefully examining the fire damage and understanding the effects, you'll be better prepared to make informed decisions about repairs, pricing, and marketing strategies for your fire-damaged house in Maryland.

Legal Considerations In Maryland

Selling a fire-damaged house in Maryland comes with unique legal challenges. Understanding and following the state's specific requirements is crucial to protect yourself from potential lawsuits and ensure a smooth transaction.

Disclosure Requirements

Maryland law requires sellers to disclose known material defects, including fire damage, to potential buyers. This transparency isn't just a legal obligation—it's an ethical one that builds trust with prospective purchasers. Here's what you need to know:

- Use the Maryland Residential Property Disclosure and Disclaimer Statement

- Be thorough and honest about all known fire damage

- Provide supporting documentation

The Maryland Residential Property Disclosure and Disclaimer Statement allows you to either disclose known defects or disclaim knowledge of the property's condition. When filling out this form, provide complete and accurate details about any known fire damage, even if repairs have been made. Include details about:

- The extent of the damage

- Completed repair work

- Any ongoing issues

To support your disclosures, share relevant documentation such as:

- Fire inspector reports

- Insurance claims

- Repair records

Remember, failing to disclose fire damage can lead to serious legal consequences and potentially void the sale. It's always better to err on the side of over-disclosure to protect yourself and maintain transparency with potential buyers.

State-Specific Real Estate Laws

Maryland has several unique laws that affect the sale of fire-damaged properties:

- Lead-based paint disclosure: For homes built before 1978, you must inform buyers about the potential presence of lead-based paint. This is particularly relevant for fire-damaged older homes.

- Home inspection regulations: While not mandatory, many Maryland buyers request home inspections. Be prepared for this process and consider how fire damage might affect the inspection outcome.

- Contract requirements: Maryland has specific rules for real estate contracts, including contingencies and timelines. Ensure your sales contract addresses any unique aspects related to the fire damage.

Importance Of Legal Counsel

Given the challenges of selling a fire-damaged house, seeking legal counsel isn't just advisable—it's essential. A qualified real estate attorney can provide invaluable assistance:

- Review and explain disclosure requirements

- Draft or review sales contracts

- Manage potential disputes

- Advice on liability issues

- Assist with complex situations

An attorney can help you understand exactly what needs to be disclosed and how to do so properly. They can ensure your contract protects your interests while complying with Maryland law. If issues arise during the sale process, legal counsel can help mediate and resolve conflicts.

A lawyer can provide guidance on potential liability concerns related to the fire damage and how to mitigate risks. This is especially important if your property has significant damage or unique circumstances that require specialized guidance.

By understanding and adhering to Maryland's legal requirements, properly disclosing fire damage, and seeking professional legal guidance, you can significantly reduce your risk of legal implications when selling your fire-damaged house. This approach not only protects you legally but also builds credibility with potential buyers, paving the way for a successful sale.

Repair Or Sell As-Is: Weighing Your Options

When faced with a fire-damaged house in Maryland, you'll need to decide whether to repair the property before selling or to sell it as-is. This choice can significantly impact your sale price, time on the market, and overall selling experience. Let's explore the key factors to consider when making this important decision.

Cost-Benefit Analysis Of Repairs

Before deciding to repair your fire-damaged house, conduct a thorough cost-benefit analysis:

- Assess repair costs:

- Obtain detailed estimates from reputable contractors for all necessary repairs

- Include both visible damage and potential hidden issues (smoke damage, structural problems)

- Evaluate potential value increase:

- Research comparable properties in your area

- Determine how much value repairs might add to your home

- Consider time investment:

- Factor in the repair timeline

- Assess how this might affect your selling schedule

- Analyze market conditions:

- Hot seller's market: Extensive repairs might not be necessary

- Buyer's market: Repairs could give your property a competitive edge

Remember, not all repairs offer the same return on investment. Focus on those that will have the most significant impact on your home's value and appeal to potential buyers.

Pros And Cons Of Selling As-Is

Selling your fire-damaged house as-is can be a viable option, but it comes with its own set of advantages and disadvantages:

Pros:

- Faster sale process

- No upfront repair costs

- Attracts investors and flippers

Cons:

- Lower sale price

- Smaller buyer pool

- Potential for lowball offers

Insurance Considerations

Your insurance policy can play a crucial role in your decision-making process:

- Review your policy: Understand what your insurance covers regarding fire damage and repairs.

- Consider claim payouts: If you've received an insurance payout, factor this into your decision. Some policies may require you to use the funds for repairs.

- Future insurability: Be aware that selling a fire-damaged home as-is might affect the new owner's ability to obtain insurance, potentially limiting your pool of potential buyers.

- Documentation: Keep all insurance-related documents, including claim reports and payout information, as these may be important during the sale process.

Whether you choose to repair your fire-damaged house or sell it as-is, transparency is key. Maryland law requires you to disclose known material defects, including fire damage, to potential buyers. This honesty not only fulfills your legal obligations but also builds trust with potential buyers, regardless of the condition in which you choose to sell your property.

By carefully weighing the costs and benefits of repairs against the potential advantages of selling as-is, and considering your insurance situation, you can make an informed decision that best suits your circumstances and the Maryland real estate market.

Local home buyer Selling a House with Fire Damage, will do our best to make you an offer you’re happy with! Simply fill in the form below to get started. Our offer is 100% FREE & there’s no obligation to accept it 🙂

Free Offer Form

We will get back to you as soon as possible.

Please try again later.

“Thank you for making it simple to sell my parent’s home. Words can’t express how emotional it was having to sell the house I grew up in. Thank you for being patient with my sister and me, for making the process simple, and for making us a decent offer instead of lowballing us like a lot of the other people that sent us letters did. You helped make the best out of a really horrible experience without the high pressure that some of the other buyers put on us.

Pricing Strategies For Fire-Damaged Properties

Determining the right price for a fire-damaged house in Maryland can be challenging. The key is to strike a balance between attracting potential buyers and maximizing your return. Let's examine effective pricing strategies to assist you with this complex aspect of selling a fire-damaged property.

Factors Affecting Valuation

Several factors come into play when valuing a fire-damaged property:

- Extent of damage: The severity and scope of fire damage significantly impact the property's value. Minor cosmetic issues will affect the price less than major structural problems.

- Location: Even with fire damage, a property in a desirable Maryland neighborhood may retain more value than one in a less sought-after area.

- Market conditions: The overall real estate market in your specific Maryland location can influence pricing. A seller's market might allow for higher pricing, even for damaged properties.

- Age and condition of the property: The pre-fire state of the house, including its age and any renovations, will factor into the valuation.

- Cost of repairs: Estimated repair costs will directly impact the property's value, as buyers will factor these expenses into their offers.

Working With Professional Appraisers

Engaging a professional appraiser who has experience with fire-damaged properties can provide valuable insights:

- Specialized expertise: These appraisers understand how to assess fire damage and its impact on property value.

- Objective valuation: An independent appraisal can offer an unbiased perspective, helping you set a realistic price.

- Detailed reports: Professional appraisers provide thorough reports that can be helpful in discussions with potential buyers.

- Local market knowledge: Appraisers familiar with the Maryland real estate market can offer location-specific insights.

When selecting an appraiser, look for certifications and ask about their experience with fire-damaged properties in your area. Their expertise can be crucial in determining a fair and attractive price for your property.

Setting Realistic Expectations

Setting realistic expectations is crucial when pricing a fire-damaged property:

- Understand market realities: Recognize that your property will likely sell for less than its pre-fire value. Be prepared for this financial reality.

- Consider multiple pricing scenarios: Develop different pricing strategies based on whether you're selling as-is or after repairs.

- Factor in time on market: A competitively priced property may sell faster, reducing carrying costs like property taxes and insurance.

- Be flexible: Be prepared to adjust your price if you're not attracting buyers. The market's response can provide valuable feedback on your pricing strategy.

- Think like a buyer: Consider what you would be willing to pay for a similar property in its current condition.

Pricing a fire-damaged house too high can lead to a prolonged time on the market, potentially resulting in even lower offers down the line. Conversely, pricing too low might mean leaving money on the table.

By carefully considering the factors affecting your property's value, working with experienced professionals, and setting realistic expectations, you can develop a pricing strategy that attracts potential buyers while ensuring you receive fair value for your fire-damaged property in Maryland.

This balanced approach will position you for a successful sale in what can be a challenging real estate situation.

Marketing Your Fire-Damaged House

Marketing a fire-damaged house in Maryland requires a unique approach. With the right strategies, you can effectively showcase your property's potential and attract interested buyers.

Crafting An Effective Listing

Creating an honest yet appealing listing is crucial when selling a fire-damaged property:

- Be transparent: Clearly disclose the fire damage in your listing. Maryland law requires sellers to disclose known material defects, including fire damage. Honesty builds trust with potential buyers and prevents legal issues.

- Highlight potential: Focus on the property's positive aspects and renovation potential. Emphasize features like location, lot size, or unique architectural elements that survived the fire.

- Use compelling visuals: Include high-quality photos that show both the damage and the property's potential. Consider virtual tours or 3D models to give buyers a detailed look.

- Provide detailed information: Include specifics about the extent of the damage, any repairs already completed, and estimates for remaining work. This information helps buyers make informed decisions.

Targeting The Right Buyers

Identifying and appealing to the right audience can significantly impact your success in selling a fire-damaged house:

- Investors and flippers: These buyers often seek properties they can renovate and resell for profit. Highlight the property's potential return on investment.

- Contractors and builders: Professionals in the construction industry might see your property as an opportunity. Emphasize the structural aspects and renovation possibilities.

- Bargain hunters: Some buyers are specifically looking for discounted properties they can restore over time. Showcase the property's value proposition.

- First-time homebuyers: With the right price point, your property might appeal to those looking to enter the housing market and willing to put in some work.

Tailor your marketing message to appeal to these specific groups, emphasizing the aspects of your property that align with their interests and needs.

Leveraging Multiple Marketing Channels

To reach a wide range of potential buyers, utilize various marketing channels:

- Online listings: List your property on popular real estate websites and local Maryland real estate portals. Ensure your listing is detailed and includes high-quality images.

- Social media: Use platforms like Facebook, Instagram, and Twitter to share your listing. Consider targeted ads to reach specific demographics interested in renovation projects

- Local real estate networks: Connect with local real estate agents who specialize in distressed properties or have experience selling fire-damaged homes in Maryland.

- Print media: While less common, local newspapers and real estate magazines can still be effective, especially for reaching older demographics or local investors.

- Word of mouth: Inform your personal and professional networks about the property. Sometimes, the best leads come through personal connections.

- Open houses: Consider hosting open houses or virtual tours to allow potential buyers to see the property firsthand and envision its potential.

By crafting an effective listing that's honest yet appealing, targeting the right buyers, and leveraging multiple marketing channels, you can significantly increase your chances of successfully selling your fire-damaged house in Maryland.

Remember, transparency about the property's condition is key, while highlighting its unique potential to the right audience can make all the difference.

Receive an Offer For Your Home That You Can ✅ Trust!

We Offer Cash Advances, Options & Flexibility Based on YOUR Needs!

Navigating The Sale Process

Selling a fire-damaged house in Maryland comes with unique challenges. Let's explore how to find the right real estate agent, negotiate with buyers, and handle inspections and appraisals.

Finding Specialized Real Estate Agents

When dealing with a fire-damaged property, working with a specialized real estate agent can make a significant difference:

- Look for agents experienced in distressed properties

- Ask about their network of investors, contractors, and cash buyers

- Verify their knowledge of Maryland's real estate laws, especially disclosure requirements

- Discuss their marketing strategies for showcasing your property's potential

Negotiating With Potential Buyers

Negotiating the sale of a fire-damaged house requires a unique approach:

- Be prepared for lower offers due to repair costs

- Highlight positive aspects like location or lot size

- Consider creative solutions such as owner financing or rent-to-own agreements

- Stay flexible, as the pool of buyers for fire-damaged homes is smaller Use your agent's expertise during tough negotiations

Dealing With Inspections And Appraisals

Inspections and appraisals for fire-damaged properties can be complex:

- Consider getting a pre-emptive professional inspection

- Be transparent with all fire-related documentation and repairs

- Understand how appraisers assess fire-damaged homes

- Prepare for additional scrutiny from structural engineers or fire restoration specialists

- Ensure the property is safe for inspections

- Be ready to negotiate further based on inspection results

Remember, selling a fire-damaged house in Maryland requires patience, flexibility, and expert guidance. By partnering with the right real estate professional, approaching negotiations strategically, and being prepared for thorough inspections and appraisals, you can successfully sell your property while meeting legal requirements and maximizing your returns.

Free Offer Form

We will get back to you as soon as possible.

Please try again later.

Alternative Selling Options

Selling a fire-damaged house in Maryland doesn't always have to follow traditional methods. Let's explore some alternative options that could lead to a quicker sale and less hassle.

Cash Buyers And Real Estate Investors

Cash buyers and real estate investors often present an attractive option for selling fire-damaged properties:

- Quick sales: Closings can happen in as little as a week

- "As-is" purchases: No need for repairs before selling

- Simplified process: Less paperwork and fewer contingencies

- Potential drawbacks: Offers might be lower than market value

To make the most of this option:

- Research reputable local investors

- Get multiple offers to ensure a fair deal

- Weigh the trade-off between a quick sale and potentially lower proceeds

Auction Possibilities

Auctions can be an effective way to sell fire-damaged properties, especially in a competitive market:

- Attract motivated buyers ready to make immediate decisions

- Set a specific timeline, creating a sense of urgency

- Potential for competitive bidding to drive up the final sale price

Types of auctions to consider:

- Absolute auctions: The highest bid wins regardless of price

- Reserve auctions: You set a minimum acceptable price

Before choosing this route, consult with a professional auctioneer familiar with Maryland real estate laws. They can guide you through the process and help you understand potential outcomes.

For Sale By Owner (FSBO) Approach

Selling your fire-damaged house yourself can be challenging but potentially rewarding:

- Cost savings: Avoid agent commissions

- Direct control: Manage the entire sale process yourself

- Flexibility: Set your own schedule for showings and negotiations

Challenges of FSBO:

- Significant time investment required

- Need to educate yourself on Maryland's real estate laws and disclosure requirements

If you choose the FSBO route:

- Consider hiring a real estate attorney to ensure legal compliance

- Invest in a flat-fee MLS listing service to increase property visibility

When exploring these alternative selling options, always keep in mind the unique aspects of your fire-damaged property and your personal circumstances.

Each option has its pros and cons, depending on factors like the extent of the damage, your timeline for selling, and your comfort level with different selling processes.

Regardless of the method you choose, ensuring transparency about the fire damage and complying with Maryland's disclosure laws remains paramount.

Maryland Real Estate Market Activity

Home Prices:

- The average home value in Maryland is approximately $419,949, reflecting a 3.6% increase over the past year.

- The median sales price was $406,000 in January 2025, marking a 5.5% year-over-year increase.

- The average sales price rose to $480,542 in January 2025, a 7.1% increase from the previous year.

Sales Activity:

- Home sales in Maryland increased by 2.1% year-over-year in January 2025, with 3,968 units sold.

- Pending sales decreased by 2.7% to 4,637 units in January 2025.

Inventory Levels:

- Active inventory fell by 10.9% year-over-year in January 2025, with 9,338 homes available for sale.

- New listings decreased by 16.2% to 4,980 units in January 2025.

- Inventory is expected to increase by 5% to 7% in 2025, though it remains below balanced market levels.

Market Trends:

- The market is characterized by rising prices and limited inventory, favoring sellers. However, there are signs of gradual improvement in inventory levels.

- Homes are selling quickly, with a median of 44 days on the market, which is significantly shorter than the national average.

Regional Variations:

- Areas like Northern Virginia and Baltimore are experiencing strong demand and rising home prices. Northern Virginia's median home price was near $700,000 in late 2024.

- Maryland's housing market is influenced by its proximity to Washington, D.C., and the strong local economy.

Economic Factors:

- Mortgage rates are a significant factor, with rates around 7.05% impacting affordability. Rates are expected to fluctuate in 2025, creating opportunities for buyers.

- Maryland has the highest median household income in the U.S., which supports housing demand despite affordability challenges.

Thanks for buying my Mother’s home. It was a big help that you were able to buy it without us having to clean it out and get it ready to sell. My mother had accumulated lots of stuff and after the stress of her long illness I was exhausted and I dreaded dealing with all of it. I also liked it that you gave me a very fair price for the home. I’m on a fixed income and that really helped a lot.

Preparing For Closing

As you near the final stages of selling your fire-damaged house in Maryland, it's essential to be well-prepared for the closing process. This crucial phase involves several key steps to ensure a smooth transaction.

Required Documentation

Gathering the required paperwork is essential for a successful closing. Here's what you'll need:

- Deed: The original deed to the property

- Title documents: A clear title report showing no liens or encumbrances

- Fire damage disclosure: A detailed account of the fire damage and any repairs made

- Repair records: Documentation of all repairs and renovations completed after the fire

- Insurance claims: Records of any insurance claims filed and settlements received

- Home inspection report: A recent inspection report, if available

Consider working with a real estate attorney to ensure all required documents are in order and comply with Maryland law.

Final Walk-Through Considerations

The final walk-through is particularly important when selling a fire-damaged property. Keep these points in mind:

- Buyer's inspection: Be ready for a thorough examination of the property's condition, especially fire-affected areas

- Agreed-upon repairs: Complete any promised repairs before this final inspection

- Disclosure accuracy: Use this opportunity to verify that your fire damage disclosures were accurate

- Utilities: Ensure all utilities are on so the buyer can test systems, particularly those affected by the fire

Transparency is key during this process. Be prepared to address any last-minute questions or concerns about the property's condition.

Closing Cost Expectations

Understanding potential closing costs can help you avoid surprises. Here are some common expenses:

- Title insurance: Protects the buyer and lender against future title problems

- Transfer taxes: Maryland imposes state and sometimes local transfer taxes on property sales

- Recording fees: Covers the cost of recording the new deed and other documents with the county

- Attorney fees: If you've hired a real estate attorney, factor in their closing process fees

- Outstanding liens: Any liens against the property, including those related to fire damage repairs, must be settled

- Prorated property taxes: You may need to pay a portion of the year's property taxes

Keep in mind that buyers interested in fire-damaged properties might request additional credits or price reductions for unforeseen repair costs. Be ready to negotiate these points at closing if necessary.

Maintain open communication with all parties involved – the buyer, real estate professionals, and your attorney. This approach will help address any issues promptly and keep the transaction on track.

Selling a fire-damaged house in Maryland requires extra attention to detail in documentation and disclosure, but with proper preparation, you can achieve a successful closing and move forward.

Should You Sell Your Burned House Home As Is In Maryland

Selling a fire-damaged house may seem like a daunting task, but with the right knowledge and strategies, it’s entirely possible. By understanding the hidden impacts of fire damage, navigating insurance claims and payouts, and choosing the best selling strategy, you can successfully sell your fire-damaged home and move forward with your life.

Remember, the key to a successful sale lies in transparency, proper disclosure, and finding the right buyer for your unique property. Armed with the information and insights provided in this blog post, you’re now ready to tackle the challenges of selling a fire-damaged house with confidence.

FAQs & Common Questions Asked by Homeowners:

-

How long does it typically take to sell a fire-damaged house in Maryland?

The timeline for selling a fire-damaged house in Maryland varies widely, typically ranging from 1 to 6 months. Several factors influence the sale duration:

- Extent of the damage

- Current market conditions

- Pricing strategy

- Decision to repair or sell as-is

Properties sold to cash buyers or investors often sell faster, sometimes within weeks.

-

What are the tax considerations when selling a fire-damaged property?

Selling a fire-damaged property may have tax consequences that you should be aware of.

- If your insurance payout exceeds your property's adjusted basis, you might owe capital gains tax.

- Selling the property for less than its original value due to fire damage may allow you to claim a capital loss.

It's crucial to consult with a tax professional for advice suited to your particular circumstances.

-

Can I still live in my house while trying to sell it after fire damage?

Whether you can live in your fire-damaged house while selling depends on:

- The extent of the damage

- Local regulations

- Safety assessments by inspectors

Minor damage might allow you to stay, but significant damage often renders a home uninhabitable. Always prioritize safety and comply with local building codes and insurance requirements.

-

What are the most common issues buyers have with fire-damaged properties?

Buyers often have concerns about:

- Hidden damage

- Structural integrity

- Long-term effects of fire and smoke

- Lingering odors

- Compromised electrical systems

- Water damage from firefighting efforts

- Unexpected repair costs

- Difficulties obtaining insurance for a previously fire-damaged property

-

How does selling a fire-damaged house affect future insurance rates?

Selling a fire-damaged house doesn't directly affect your future insurance rates. However:

- When purchasing another property, your history of filing a fire-related claim might influence your new policy's rates.

- Insurance companies may view you as a higher risk, potentially leading to increased premiums.

- To mitigate this:

- Discuss your situation with insurance providers

- Implement fire prevention measures in your new home

- Consider shopping around for the best rates and coverage options

Conclusion

Selling a fire-damaged house in Maryland is a complex process that demands careful planning, legal compliance, and realistic expectations. By following the outlined steps, you can address the challenges and increase your chances of a successful sale.

Key takeaways for selling a fire-damaged property in Maryland:

- Legal compliance is crucial. Always disclose known material defects, including fire damage, to potential buyers. This transparency fulfills your legal obligations and builds trust.

- Set realistic expectations. Understand that fire damage may affect your property's value, and be prepared for negotiations.

- Price appropriately. Consider various selling options to maximize your chances of a successful transaction.

- Seek professional assistance. Experienced real estate agents, legal counsel, and professional inspectors can provide invaluable guidance and support.

Remember, thorough preparation is the cornerstone of successfully selling a fire-damaged house. By leveraging professional help and implementing the strategies discussed, you can approach the sale with confidence.

With the right mindset and approach, you can transform this challenging situation into a successful property transaction. Stay focused on your goals, remain patient throughout the process, and don't hesitate to seek expert advice when needed.

By taking these steps and keeping a proactive mindset, you'll be well-prepared to handle the process of selling your fire-damaged house in Maryland and move on to your next endeavor.

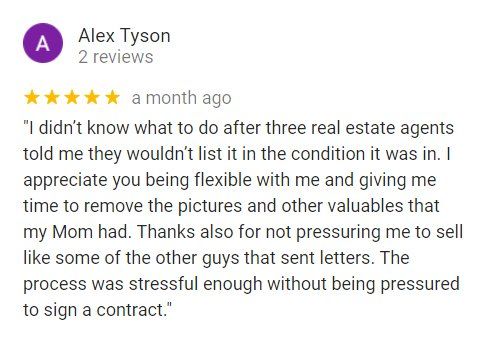

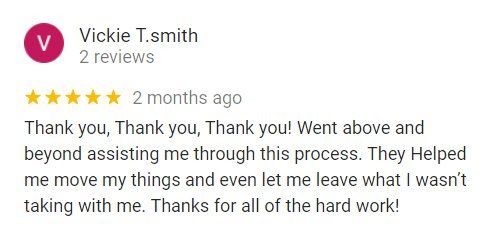

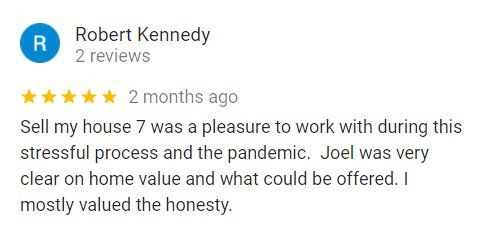

100+ Happy Online Reviews

We Must Be Doing Something Right!

So Many People Happy About Our Services – We Know You’ll Be Happy Too!

There’s ZERO Risk for You to Contact Us & Get an Offer – You Can Always Says “No”!